New Change to the Maryland Child Support Guidelines – the Multifamily Adjustment

If you have gone through a custody, child support or divorce case with children, you likely know that there are Child Support Guidelines in Maryland. The guidelines are mandatory in any case where the parents have combined gross monthly income of $30,000 or less. If the parents make a combined income of more than $30,000 per month, then the guidelines are not mandatory but help the court in determining an appropriate amount of support, along with other factors not considered under the mandatory guidelines.

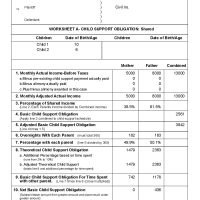

The child support guidelines look at a limited amount of information including each parent’s gross monthly income (pursuant to Md. Code Ann. Family Law § 12-201), any award of alimony, any pre-existing child support payments, the monthly health insurance premium costs for the minor child(ren), the number of overnights, and potentially extraordinary medical expenses and work-related child care expenses. The numbers go into a calculator along with the number of overnights for each parent and then the guidelines produce an amount of child support from one parent to the other.

If you are interested in the child support guidelines, there is a calculator available online at the DHS website here: MD Child Support Guidelines

As of October 1, 2025, new legislation is changing a key component of the child support guidelines. While there has always been a provision for “preexisting reasonable child support obligations actually paid”, which most courts have interpreted as court-ordered child support payments from another case, the new law will include:

“an allowance for each child living in a parent’s home to whom the parent owes a legal duty of support if the child is considered to be spending more than 92 overnights in the parent’s home in a year and are not subject to the support order.” Md. Code Ann. § 12-201(c)(1)(iii), effective October 1, 2025.

In order to calculate the amount of child support for the “other children” in the home, you use that parent’s monthly income (without income from the other parent) and multiply the basic child support obligation by .75. 12-204(e), effective October 1, 2025.

It makes sense that if you have minor children at home (either with a new partner or spouse) whom you are legally obligated to support, that some credit should be given to caring for those children, but what could this actually look like when applied?

By way of example only, and based solely on the law going into effect on October 1, 2025, if the parent’s actual gross income is $60,000 per year, or $5,000 per month, and there is one child in that parent’s care not subject to an ongoing child support order and not subject to the pending child support guidelines, that parent’s actual income could be reduced by $693 (.75 multiplied by the basic child support obligation), which would then reduce the overall income for the pending child support guidelines and could change the amount of child support that you pay or receive.

As with anything in family law, there is an exception. If the court finds that including the allowance for the other child(ren) in the parent’s care would be unjust or inappropriate, after considering the best interest factors for the child subject to the pending child support guidelines, then the court can decline to include the allowance for the parent. Since the guidelines are not in effect yet, it is hard to speculate as to what a court would determine to be unjust or inappropriate for the exclusion of the allowance.

The other unclear issue is if the implementation of the Multifamily Adjustment is, in and of itself, enough to modify existing child support orders. While past child support guideline changes have specifically stated they do not constitute a material change warranting recalculating guidelines, the current law is silent on that issue. It will likely depend on the circumstances and amount of income.

If you have a current child support case, or have questions about child support, you should speak with an experienced attorney to help you navigate the growingly-complex area of law. Weinberg and Schwartz has a team of dedicated attorneys solely focused on family law issues as we would be more than happy to review your case with you.